Moniepoint, a fintech giant that operates one of Nigeria’s largest agent networks, has released its first informal economy report, detailing key insights into the informal economy such as financial habits and digital payments trends. The fintech spoke to over 2 million Nigerian businesses that signed up on its platform between 2019 and 2024 and excluded data from the thousands of agents

Here are five interesting things we learned from the report.

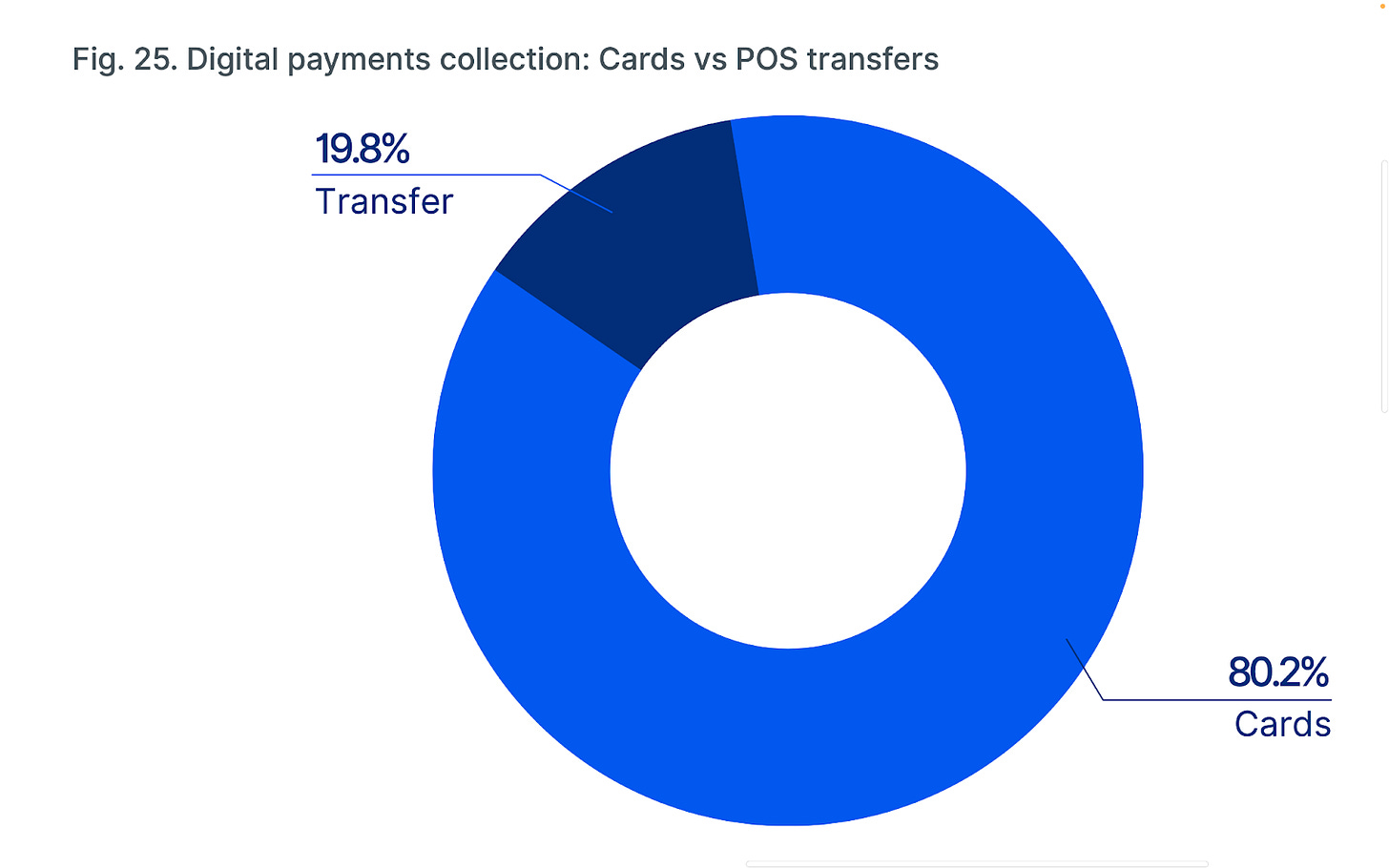

Cards dominate offline payments

Of the 2 million businesses Moniepoint interviewed, about 80% prefer card payments to transfers for in-person transactions. This is in contrast to online payments dominated by online transfers, according to figures from the central bank. Digital payments enjoyed its best year ever in 2023, after an ill-thought cashless policy that made cash scarce forced many Nigerians to use digital means of payment. Despite a reversal of the policy, Nigerians still stuck to digital payments and companies like Moniepoint which processed 5.2 billion transactions, quickly became part of daily life.

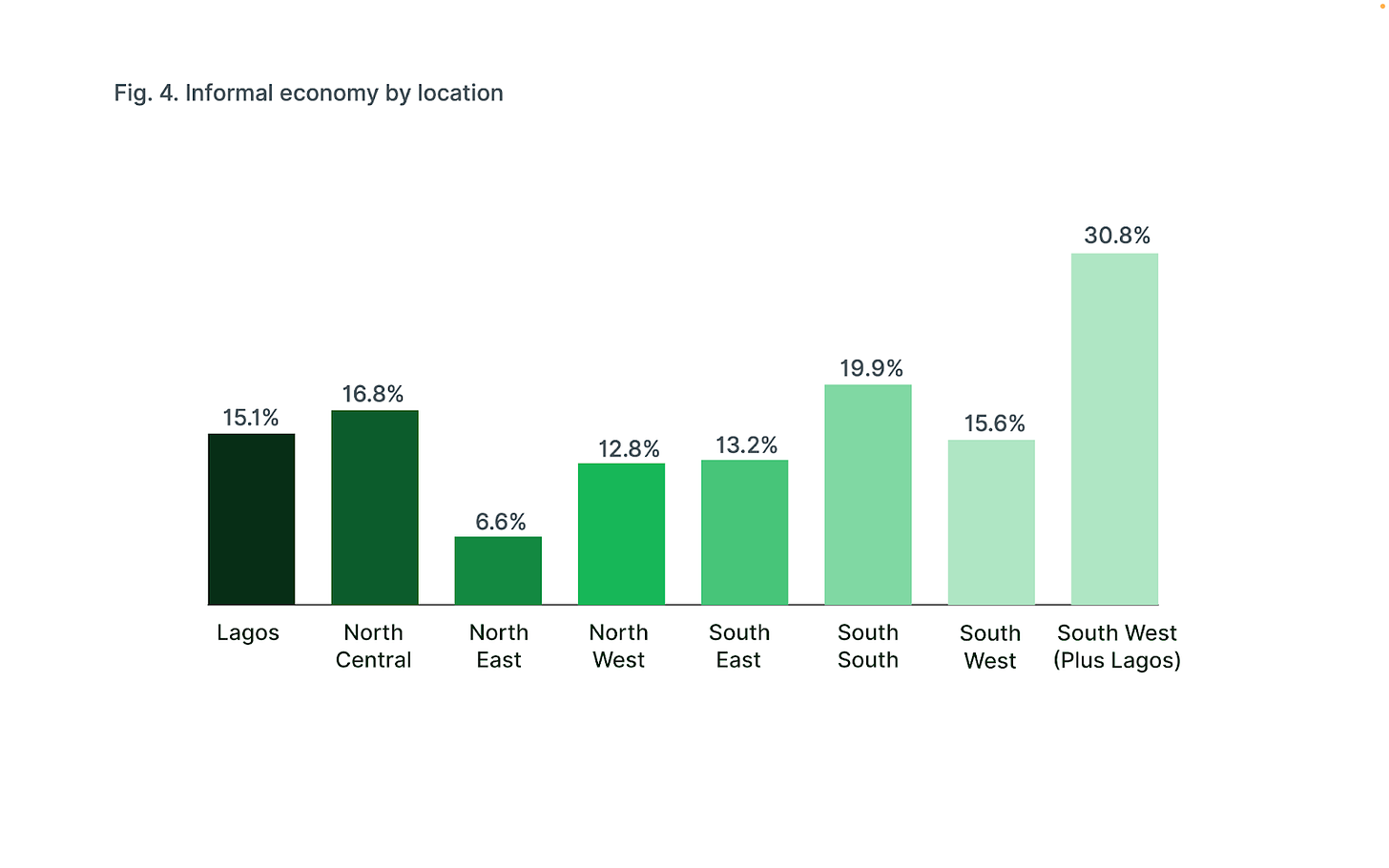

Unsurprisingly, Lagos is Nigeria’s commercial capital

Lagos has always been Nigeria’s cash cow despite being its smallest state since the country’s independence thanks to its location and it being the first capital of the country. The state houses 15% of Nigeria’s informal economy, and is only surpassed by the North Central region—the nation’s food basket and home to the current capital— and the South West, where Lagos is located.

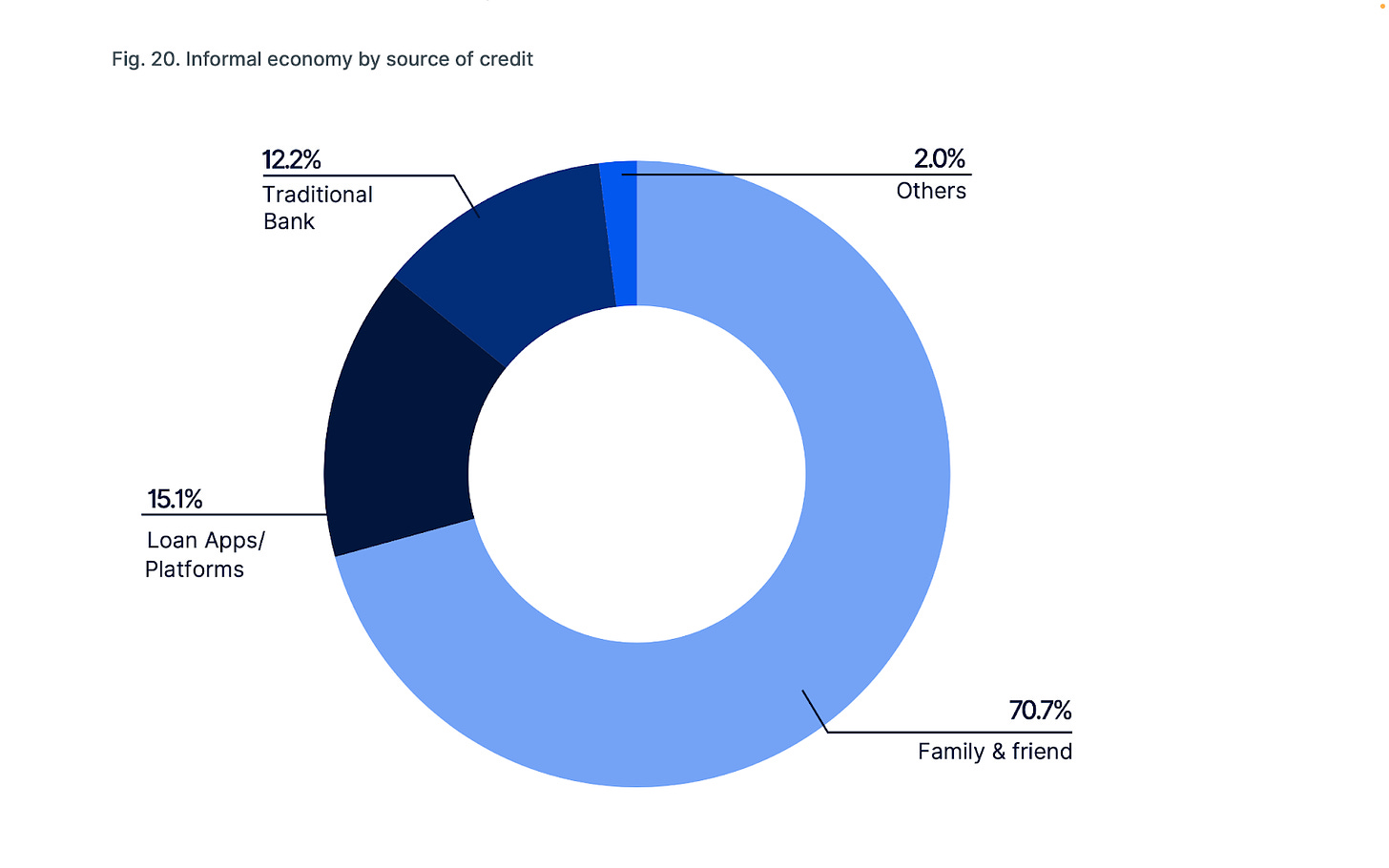

Nigerian businesses would rather borrow money from loan apps than banks

When loan apps burst onto the scene, they had a compelling reason to offer credit to Nigerians as commercial banks typically did not offer loans to small businesses and individuals. According to a 2023 report, credit use in Nigeria is only 6%. While the informal economy prefers to borrow money from friends and family, loan apps came in second and have surpassed traditional banks.

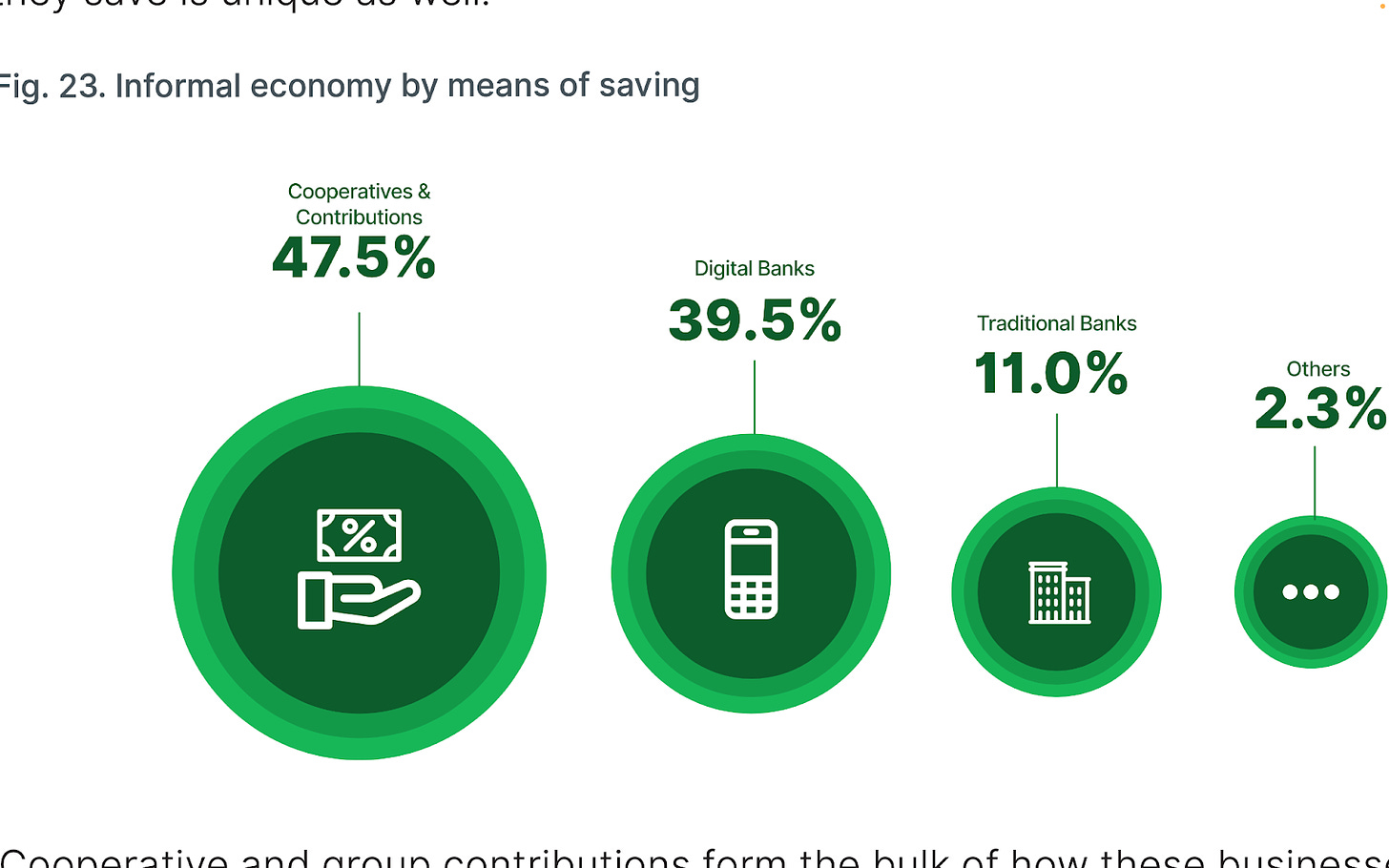

Nigerian businesses prefer saving on digital platforms to banks

According to Moniepoint’s report, 92.4% of informal businesses save money but would rather save on digital platforms than traditional banks, showing the growing influence of fintechs in Nigeria. Cooperatives and contributions account for almost half of the saving choices of the informal economy, as they are run by members of the informal sector. For the fintechs, customers saving on their platform represent a boon to the bottom line as these deposits become the loans they give out to customers.

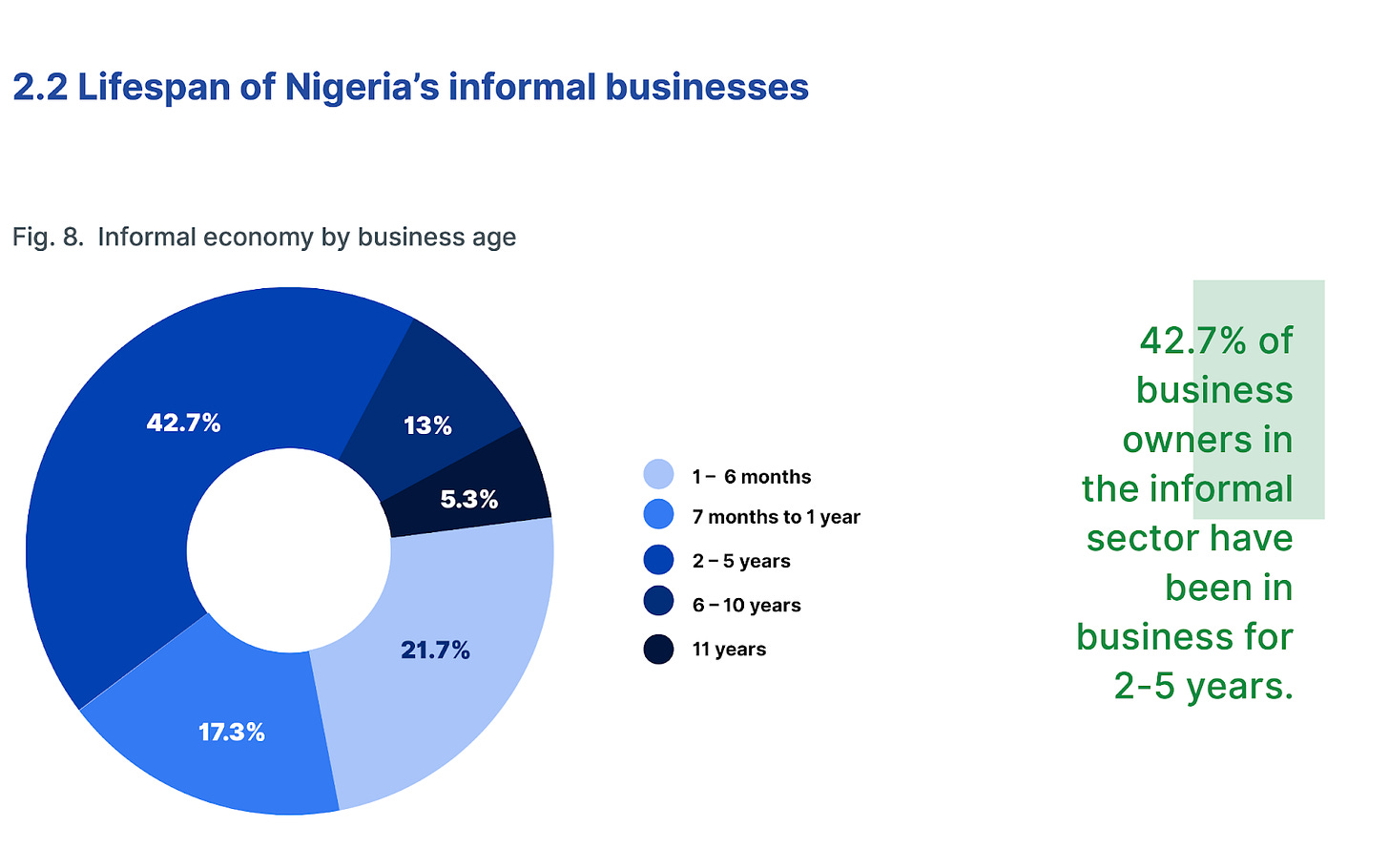

Nigerian businesses are relatively young

More than 80% of respondents said that their business was more than five years old, a worrying trend that shows most businesses are dying young. The majority of businesses have been around for less than 5 years but more than 2 years, which was followed by businesses that were more than six months old but younger than a year.