In a bold move that signals its ambitions for continental dominance, Chowdeck, the Nigerian food delivery powerhouse, is exploring expansion into South Africa, Kenya, and Ivory Coast. This strategic initiative comes as the company celebrates a milestone of one million registered users and seeks to replicate its success in Lagos across other African markets.

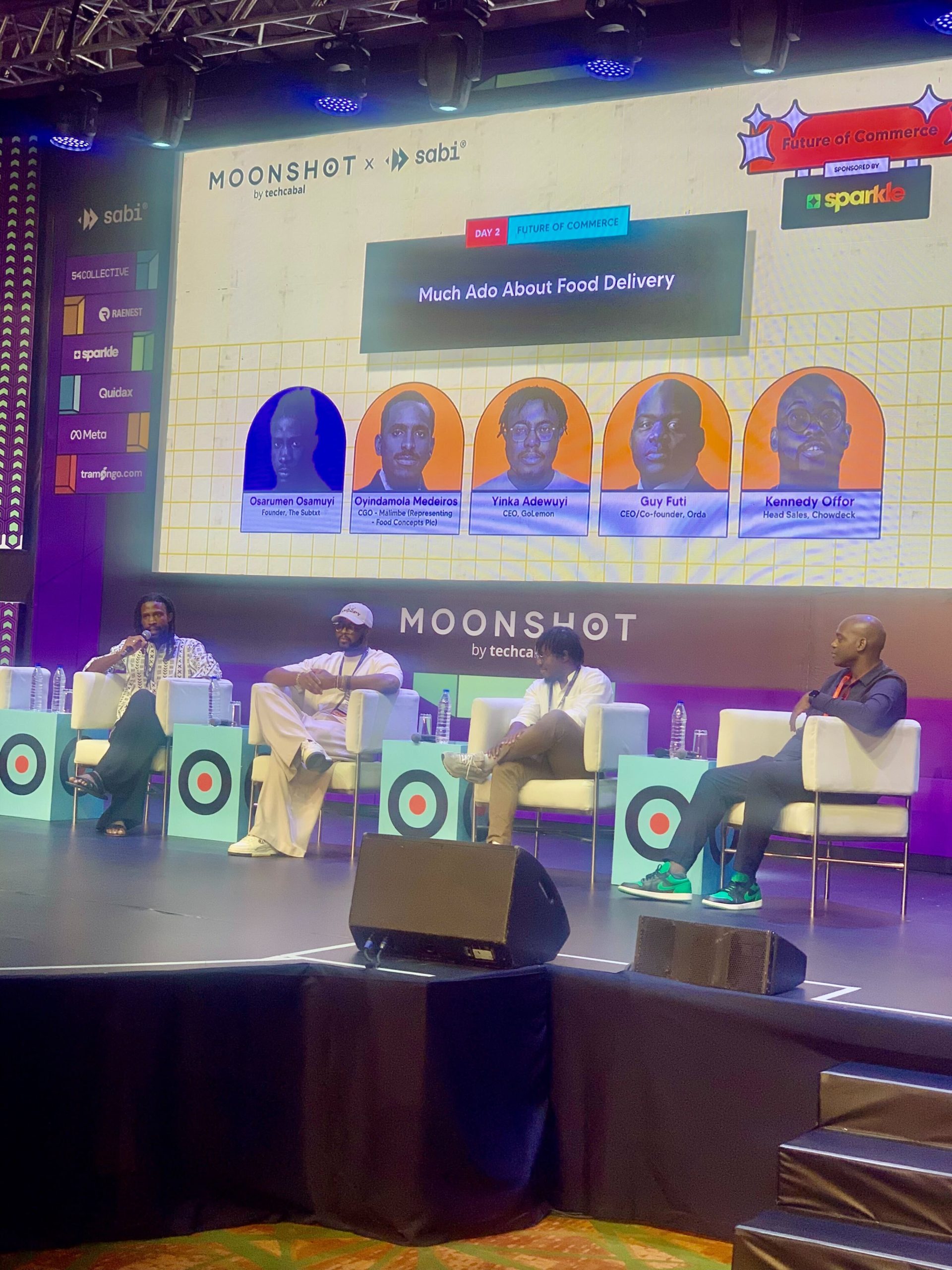

Kennedy Offor, sales lead at Chowdeck, revealed the company’s expansion plans during the Moonshot by TechCabal event on Thursday. “We are still figuring things out, but we are looking at these countries because they have a mature market. Especially South Africa,” Offor stated, highlighting the company’s focus on established food delivery ecosystems.

Competitive Landscape and Market Dynamics

The food delivery markets in South Africa, Kenya, and Côte d’Ivoire present both opportunities and challenges for Chowdeck:

- South Africa: The most developed market among the three, dominated by Mr D Food (a Takealot Group subsidiary), Uber Eats, and local player Zulzi. According to a report by Statista, the South African online food delivery market is expected to reach $1.9 billion in revenue by 2025, with a user penetration of 29.9%.

- Kenya: A growing market with Glovo and Bolt Food as major players. The Kenya Food Delivery Market is projected to grow at a CAGR of 5.8% during 2023-2028, as per Market Research Future (MRFR).

- Côte d’Ivoire: An emerging market with Glovo and Uber Eats already present. The country’s e-commerce sector, including food delivery, is experiencing rapid growth, with a projected CAGR of 11.8% between 2023-2027, according to Mordor Intelligence.

Chowdeck’s Current Performance and Strategy

Chowdeck currently processes 40,000 deliveries daily, with 70% originating from Lagos State. This concentration highlights both the company’s strong foothold in Nigeria’s economic capital and the potential for growth in other regions.

To fuel its expansion, Chowdeck has adopted a multi-pronged approach:

- Vertical Integration: The company has diversified its offerings to include grocery delivery, medicine shopping, advertising, and last-mile logistics. This strategy aligns with global trends in the food delivery sector, where companies like Deliveroo and DoorDash have expanded into multiple verticals to increase customer retention and lifetime value.

- Data-Driven Restaurant Expansion: Chowdeck is leveraging its data to help restaurant partners open new outlets in high-demand areas. “By opening outlets closer to places where the data shows frequent orders come, we are ensuring that food gets to people faster and at a more affordable rate,” Offor explained. This approach not only improves delivery efficiency but also strengthens relationships with restaurant partners.

- Strategic Partnerships: In August 2024, Chowdeck signed an exclusive partnership with Chicken Republic, a major quick-service restaurant chain with nearly 100 outlets across Nigeria. Such partnerships are crucial for scaling operations and improving market penetration.

- Product Innovation: The company is actively involved in product development with its partners. Recently, it collaborated with Chicken Republic to launch a new food product, demonstrating its commitment to value-added services for restaurant partners.

Challenges and Opportunities

While expansion presents significant growth opportunities, Chowdeck will face several challenges:

- Regulatory Hurdles: Each country has its own regulatory framework for food delivery services. Navigating these will be crucial for successful expansion.

- Local Competition: Established players in each market have already built brand recognition and customer loyalty.

- Infrastructure Differences: Varying levels of road infrastructure and traffic conditions in different cities may require adaptations to Chowdeck’s delivery model.

- Cultural Nuances: Food preferences and ordering habits can differ significantly across countries, necessitating localized approaches.

Despite these challenges, the potential rewards are substantial. The African food delivery market is projected to reach $6.3 billion by 2030, growing at a CAGR of 15.8% from 2023 to 2030, according to Allied Market Research.

Industry Expert Opinions

Dr. Olayinka David-West, a professor of Information Systems at Lagos Business School, commented on Chowdeck’s expansion plans: “The move into other African markets is a natural progression for Chowdeck. However, success will depend on their ability to adapt their model to local contexts while maintaining the efficiency that has made them successful in Nigeria.”

Looking Ahead

As Chowdeck prepares for international expansion, it continues to focus on strengthening its position in Nigeria. The company is working to increase the number of restaurants in its network and support existing partners in opening new locations.

Offor emphasizes the importance of mutual growth: “We figure out ways to help them grow as much as we can, whether it’s quick delivery or the amount of data we’re able to give them in terms of where orders are coming from.”

This symbiotic relationship with restaurants appears to be a core philosophy for Chowdeck, one that the company believes will translate well to new markets. As the African food delivery landscape continues to evolve, Chowdeck’s data-driven approach and focus on partner growth position it as a formidable contender in the race for continental market share.

The coming months will be critical as Chowdeck finalizes its expansion plans and prepares to take on new challenges beyond Nigerian borders. Industry observers and competitors alike will be watching closely to see how this Nigerian success story unfolds on the broader African stage.