Regfyl, a Nigerian company specializing in digital identity verification and fraud detection, has raised $1.1 million in pre-seed funding to expand its operations. The funding, led by Rally Cap with participation from Techstars, DCG, Musha Ventures, and Africa Fintech Collective, will bolster Regfyl’s sales, engineering, and customer support teams. Additionally, the company plans to develop a supply chain compliance product as part of its growth strategy.

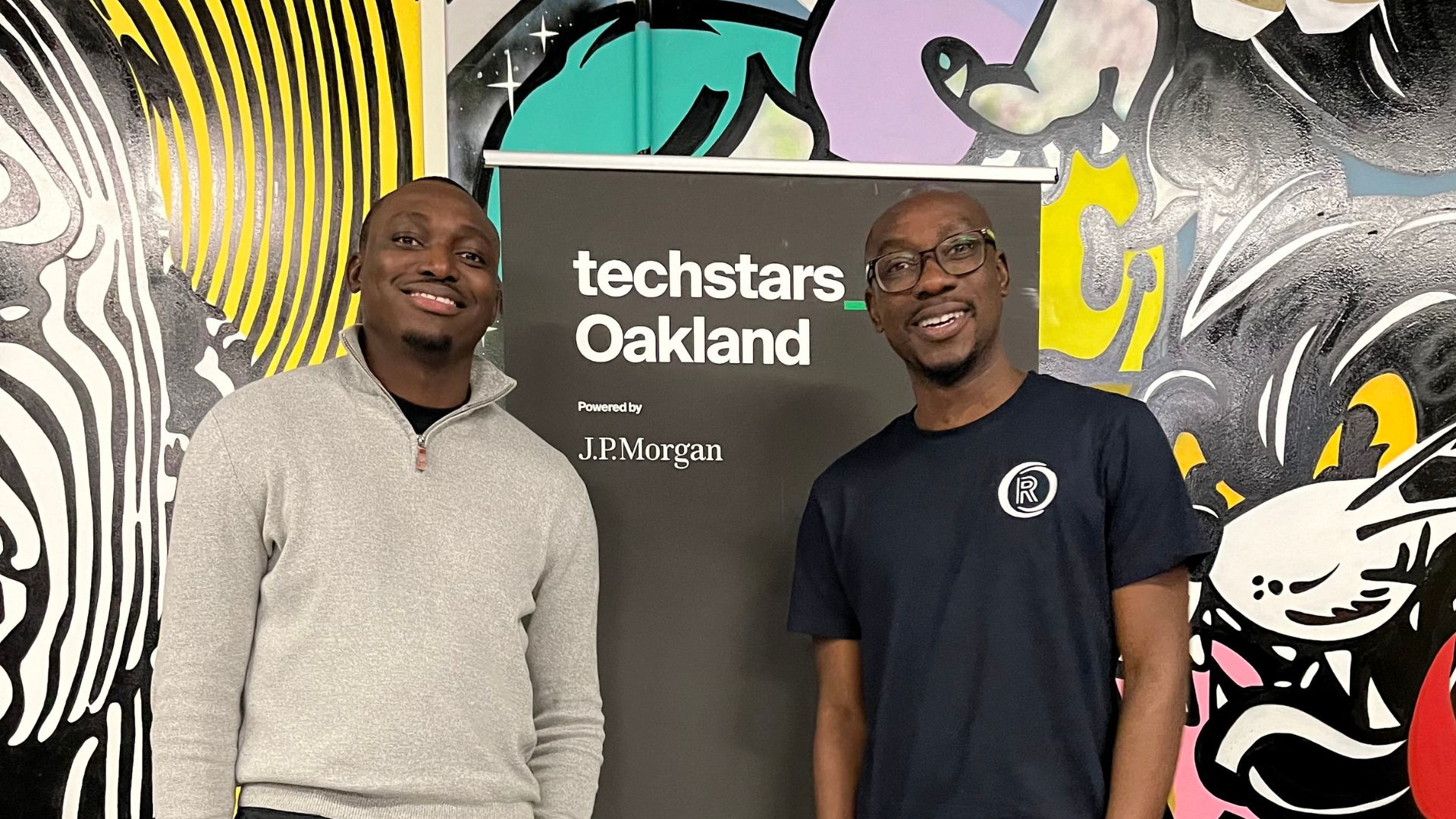

Founded in 2023 by Tunde Ibidapo-Obe and Tomiwa Erinosho, Regfyl offers businesses a comprehensive platform for customer onboarding, transaction monitoring, and fraud prevention. The platform also assists financial institutions with regulatory reporting, meeting compliance standards set by bodies like the Nigerian Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). The startup currently serves about 20 clients, including top financial players like Cowrywise, VFD Bank, Coronation, Piggyvest, and Budpay.

Regfyl’s mission centers around building trust in Africa’s digital economy. As Ibidapo-Obe, the CEO, stated, “Trust is the currency of the digital economy, and at Regfyl, we are committed to being the operating system that underpins this trust across the continent.” The company offers a yearly subscription to its platform at ₦2 million ($1,220), alongside a per-use fee for individual or business customer screening.

In a market that has seen Nigerian banks lose $25.7 million to fraud in just the second quarter of 2024, according to the Financial Institutions Training Centre (FITC), Regfyl’s services are critical. Its ability to integrate various compliance processes sets it apart from competitors like SmileID, Dojah, and Youverify, which typically offer single-service compliance tools. Erinosho, co-founder of Regfyl, highlighted this distinction by stating, “We’ve essentially brought all the tasks of a compliance manager into one operating system.”

With the pre-seed funding and its expanding client base, Regfyl is positioning itself as a leader in Africa’s growing compliance and fraud prevention market, promising to streamline KYC, transaction monitoring, and regulatory reporting for businesses across the continent.