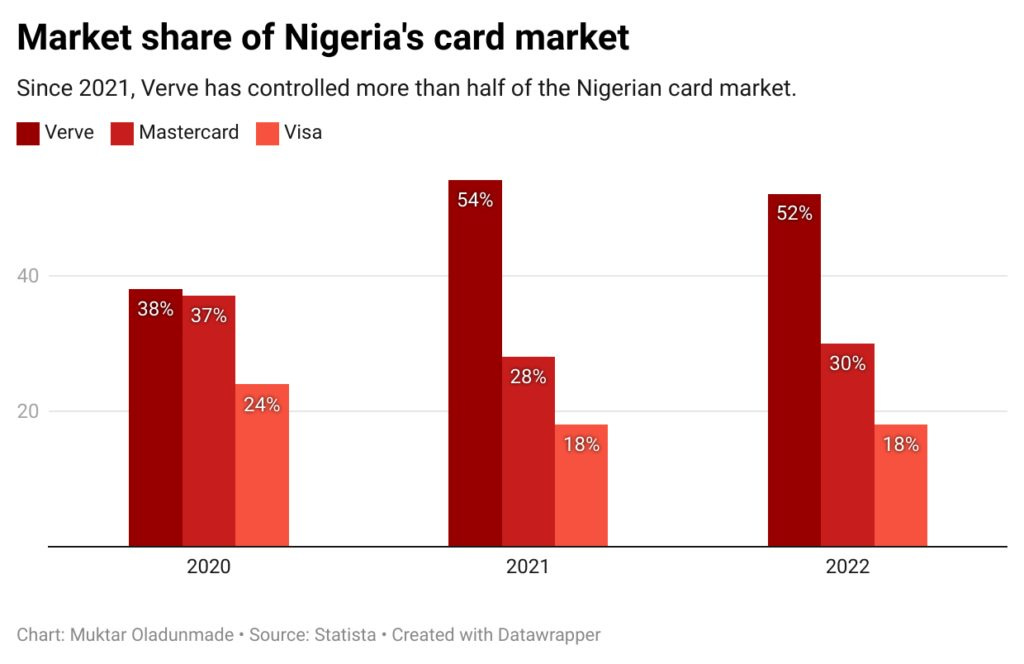

The Nigerian fintech landscape is undergoing a significant shift as banks and startups are increasingly issuing local cards like Verve and Afrigo, ditching international giants Visa and Mastercard. This move is driven by a confluence of factors, including changing consumer behavior, a challenging macroeconomic environment, and the growing popularity of bank transfers.

Pre-Pandemic Boom and Bust:

Prior to the COVID-19 pandemic, Nigerian fintechs relied heavily on issuing foreign debit cards as a customer acquisition strategy. These cards, often offered at little to no cost, allowed users to withdraw cash and make purchases domestically and internationally. This approach fueled spending and generated transaction fees for fintech companies.

COVID-19 and the Cash Crunch Reshape Consumer Habits:

The pandemic, coupled with the 2023 cash crunch in Nigeria, significantly impacted consumer behavior. Restrictions on in-person shopping and ATM cash shortages led to a decline in card usage and a rise in bank transfers. Fintechs and banks were forced to adapt their strategies to this new reality.

The Rise of Local Card Schemes:

Several factors are contributing to the rise of local card schemes like Verve and Afrigo:

- Cost Advantages: The devaluation of the Naira has made USD-denominated fees associated with international cards more expensive for Nigerian banks. Local card schemes offer a cost-effective alternative.

- Reduced Complexity: Local schemes eliminate the complexities of international card schemes, such as 300-page pricing guides, hefty monthly implementation fees, and offshore account requirements.

- Direct Fintech Integration: Unlike international schemes, Verve and Afrigo allow fintechs to connect directly, bypassing the need to partner with commercial banks.

- Alignment with Customer Needs: With inflation squeezing spending power, the global payment capabilities offered by international cards are less relevant for a large segment of the Nigerian customer base. Most transactions involve local Point-of-Sale (POS) payments.

- Regulatory Alignment: The Central Bank of Nigeria’s launch of Afrigo aligns with its cost-saving goals and may appease regulators who recently imposed a six-week ban on new customer onboarding for some fintechs.

The Growing Role of Bank Transfers:

The rise of online bank transfers presents another challenge to international card schemes. Paystack, a Stripe-owned company, reported a significant increase in bank transfer usage in Nigeria, jumping from 28% in 2022 to 58% in 2023. Bank transfers offer better margins for fintechs compared to card transactions due to the elimination of multiple processing fees.

The Future of International Cards in Nigeria:

While Nigerian fintechs embrace local alternatives, international card schemes like Visa and Mastercard are not sitting idly by. They have invested heavily in Africa, pouring at least $700 million into the continent’s fintech industry. Additionally, they are reportedly considering collecting fees in Naira to remain competitive.